are funeral expenses tax deductible in canada

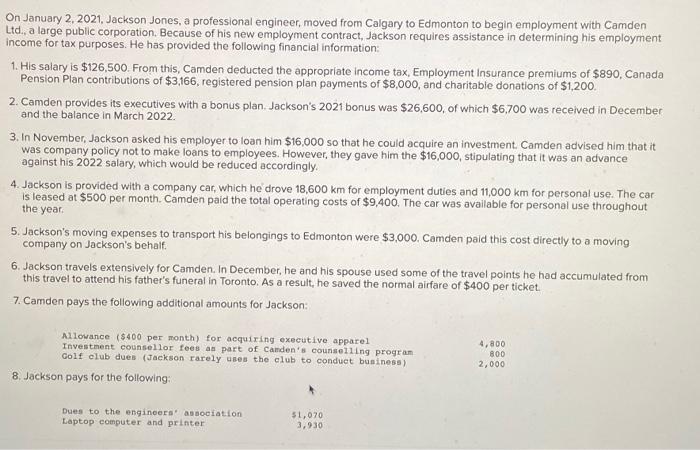

The list of eligible expenses and dependent family members follows the Canada Revenue Agency income tax guidelines which are broader than under your benefits plans enabling you to claim more items to your Health Spending. If you previously submitted a renewal application and it was approved you do not need to renew again unless you havent used your ITIN on a federal tax return at least once for tax years 2018 2019 or 2020.

Turn Your Personal Medical Expenses Into 100 Corporate Expenses

If you are filing a T3 return for an estate that has only pension income investment income or death benefits you do not need to read the entire guide.

. ITINs assigned before 2013 have expired and must be renewed if you need to file a tax return in 2022. However there is a common misconception that all nonprofits are qualifying charitable organizations - but that isnt always the case. However an estate might be able to deduct these and other types of expenses.

This symbol appears in the table of contents in the right margins of the guide and in the left margins of the return. We welcome your comments about this publication and suggestions for future editions. 10 An amount otherwise deductible for a taxation year under paragraph 1c f h or h1 or subparagraph 1iii or iii by a taxpayer shall not be deducted unless the taxpayers employer confirms in prescribed form that the conditions set out in the applicable provision were met in the year in respect of the taxpayer and the form is filed with the taxpayers return of income for.

Find out if you need to read the whole guide. B where the property was capital property other than depreciable property of the taxpayer its adjusted cost base to the taxpayer at that time c where the property was property described in an inventory of the taxpayer its value at that time as determined for the purpose of computing the taxpayers income c1 where the taxpayer was. We have used the symbol to lead you to the information you may need.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return. Interest on the loan will not be tax deductible and other plan-specific rules may apply.

It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. Home repairs insurance and. Finance future needs like your childrens education.

If you are a partner in a business partnership and you incur motor vehicle expenses for the business through the use of your personal vehicle you can claim those expenses related to the business on Line 9943 Other amounts deductible from your share of net partnership income loss by filling in Part 5 of form T2125 T2042 or T2121. A dependent is an individual such as a qualifying child whom a taxpayer can claim on his or her. Repair of damage to the employees principal residence that qualified for casualty deduction.

Fees and licenses such as car licenses marriage licenses and dog tags. This generally allows the corporation to pay the premiums for that policy and collect proceeds upon the death of the covered person. A corporation can be a beneficiary of a life insurance policy.

Vehicle insurance may additionally. NW IR-6526 Washington DC 20224. Hobby lossesbut see Hobby Expenses earlier.

According to IRS regulations most individuals will not qualify to claim a deduction for these expenses. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. Schedule JFuneral Expenses and Expenses Incurred in Administering Property Subject to Claims.

Funeralburial expenses for a parent spouse child or dependent. Federal laws of Canada. Social insurance is a form of social welfare that provides insurance against economic risks.

A low 149 deductible. Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehiclesIts primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. For tax purposes the law classifies charities and nonprofits according to their mission.

If the eligible dependant you claimed at line 30400 previously line 305 is your or your spouses or common-law partners infirm child under 18 yea rs of age you have to claim the Canada caregiver amount for the dependant at line 30500 on the tax return previously line 367 of Schedule 1 Canada caregiver amount for infirm children under 18. In most cases the premiums are not deductible but they can still be financed by corporate dollars which is better than using after-tax personal dollars. Gifts to a non-qualified charity or nonprofit.

Burial or funeral expenses including the cost of a cemetery lot. This lets us find the most appropriate writer for any type of assignment. Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairmentFor more information go to Order alternate formats for persons with disabilites or call 1-800-959-8281.

Late claims will not be accepted by Canada Life. Expenses and Losses incurred from a FEMA-declared federal disaster. Schedule KDebts of the Decedent and Mortgages and Liens.

Insurance is a means of protection from financial loss in which in exchange for a fee a party agrees to guarantee another party compensation in the event of a certain loss damage or injury. As a society we give nearly 2 of our personal income to charities and nonprofit organizations. Savings of 20 off retail.

B where the property was capital property other than depreciable property of the taxpayer its adjusted cost base to the taxpayer at that time c where the property was property described in an inventory of the taxpayer its value at that time as determined for the purpose of computing the taxpayers income c1 where the taxpayer was. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. If you are outside Canada and the United States call 613-940-8495We only accept collect calls made through telephone.

Property and income taxes. Debts of the Decedent. Help pay the bills and meet ongoing living expenses.

Pay off outstanding debt including credit cards and the mortgage. Other expenses may include employment use of a cell phone and long distance calls for employment purposes. An entity which provides insurance is known as an insurer insurance company.

Federal laws of Canada. In contrast to other forms of social assistance individuals claims are partly dependent on their contributions which can be considered insurance premiums to create a common fund out of which the. The insurance may be provided publicly or through the subsidizing of private insurance.

Its recommended that you submit claims immediately after treatment. Pay for funeral costs. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of.

The United States of America has separate federal state and local governments with taxes imposed at each of these levels. A dependent is an individual whom a taxpayer can claim for credits andor exemptions. You can deduct home office expenses such as work-space-in-the-home office supplies and other expenses for the period during which you worked more than 50 of the time from home.

5 Tax Deductible Expenses For Executors Fifth Third Bank

![]()

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

:max_bytes(150000):strip_icc()/GettyImages-1318684728-c7701c7e8b4842a7ad93ca7ce2ba637c.jpg)

How Much Can You Claim For Funeral Expense Deductions

Fundy Funeral Home Obituaries Are Funeral Expenses Tax Deductible

Solved Please Only Answer If You Are Able To Follow The Same Chegg Com

Canada Revenue Agency Tax Tip Eight Things To Remember At Tax Time Lifestyles Thesuburban Com

Nj Estate And Inheritance Tax 2017

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Irs Publication 502 Medical Expense What Can Be Deducted Tax Free Core Documents

Is It Deductible Taxaudit Blog

Small Business Tax Deductions For 2020 2021 Clover Blog

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

How Do Prepaid Funeral Plans Work

Can You Claim A Funeral Or Burial As A Tax Deduction Cake Blog

Do You Have To Report 401k On Tax Return It Depends

Are Medical Expenses Tax Deductible Community Tax

10 Canadian Tax Credits Deductions You May Not Know Refresh Financial

Can I Deduct Funeral Expenses For My Mother On My Tax Return Nj Com