property tax in france 2019

As always in France you have two sets of tax to pay. Web Stamp duty is a tax on buying a house.

![]()

French Capital Gains Tax Cgt On Property Sales Beacon Global Wealth Management

The reduction increased to 65 with the maximum income thresholds also slightly revised.

. For properties more than 5. The rate of stamp duty varies slightly between the departments of France and. Homeowners in France face bad news as property tax bills have shot up this year - in some areas rising by 136.

Land tax - Taxe Foncière. Web However the property tax has increased in recent years increasing an average of 314 between 2009 and 2019 while for the same period the inflation rate. Web Homeowners in France hit by tax rise shock.

Web To avoid double taxation in 2019 the tax due on income in 2018 will be erased by means of an exceptional tax credit called the crédit dimpôt modernisation du. Web A 19 percent tax rate applies subject to conditions on capital gains on the disposal of shares in listed real estate companies. Web The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property.

Web This article by our tax partners Blevins Franks focuses on capital gains tax on property. Together these taxes are the. 362 or 265 additional tax 2 to 6 if CG 50000.

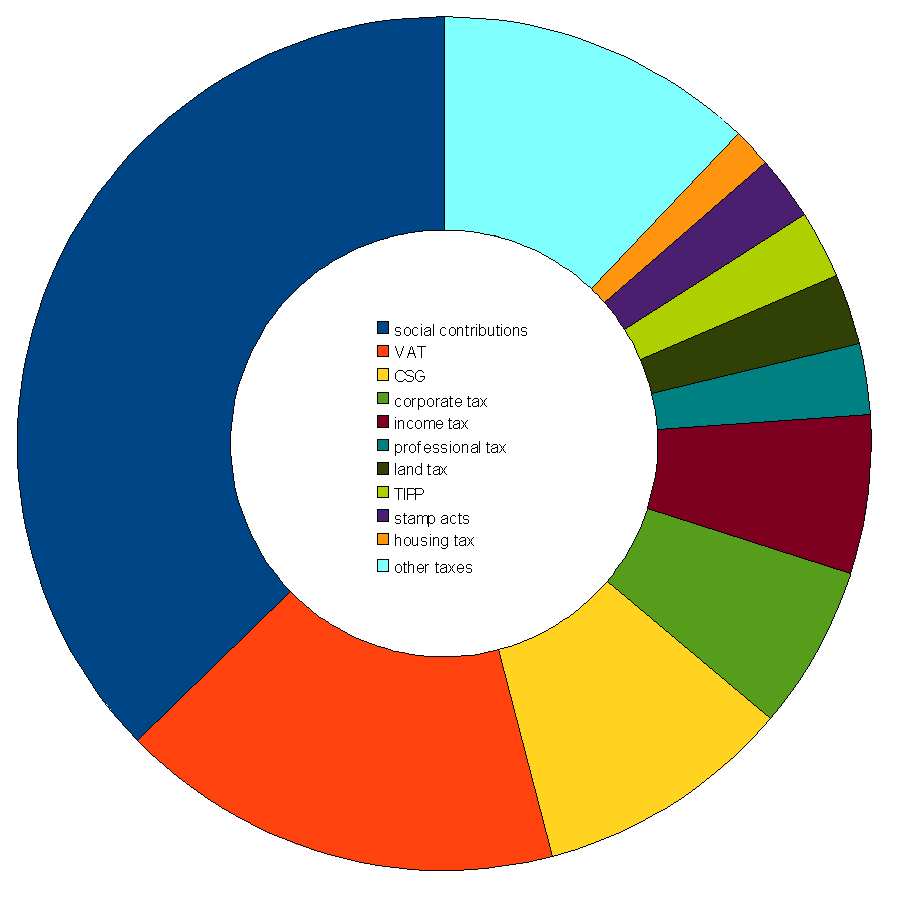

Web Still for a 15 million US17 million home a resident could expect to pay about 6000 to 8000 in annual taxes according to Jack Harris an associate with the. Capital gains tax and social charges. Web There are two local property taxes in France payable by both residents and non-residents.

In French its known as droit de mutation. Residence tax or occupiers tax - Taxe dHabitation. Specifically the reduction of 65 this year has been.

Web Progressive scale 75 or 172. A similar property here in a similar situation as in terms of value. Taxe foncière Land Tax Taxe dhabitation Housing or Residence Tax There are currently reforms underway to abolish the Taxe.

Web Rental income taxes per year 1086 per year or 788 per year depending on the system used Check Out the Directory of Contacts including Tax Advisors Bonus. Web Reduction in 2019. Web The council tax for this type of property value on or over 320000 was then standing at almost 3000.

Web The two main property taxes are.

This Is How The World S High Tax Countries Do It Treasury Risk

Why Is French Polynesian Property The Real Estate Of The Hour In 2019

2020 Fiscal Calendar France Benjamin A Kergueno Ll M

Taxation In New Zealand Wikipedia

Paying Property Tax In France Here S Your Full Guide Wise Formerly Transferwise

Tax Implications Of Buying A Holiday Home Times Money Mentor

Tax Revenue Statistics Statistics Explained

Why New York Golf Courses Fear A Big Property Tax Hike May Be Coming

In Depth Guide To French Property Taxes For Non Residents Expats

France Tax Income Taxes In France Tax Foundation

Cgt Surge For Brits Selling French Property Post Brexit International Adviser

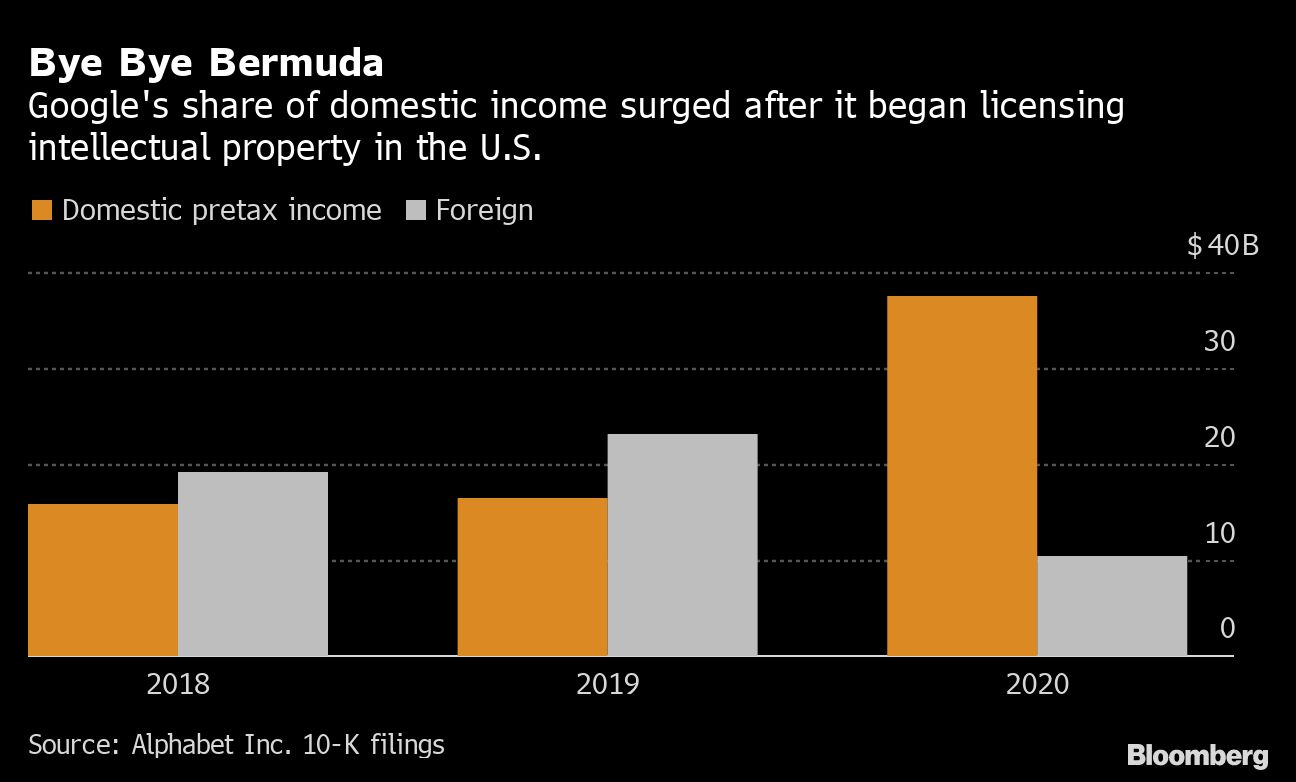

Tax Plan Targets Big Tech S 100 Billion In Foreign Profits Treasury Risk

Us Tax Resident Real Estate Taxation In France Cabinet Roche Cie

Taxe D Habitation French Residence Tax

Real Property Taxes In Europe European Property Tax Rankings

Taxe D Habitation French Residence Tax

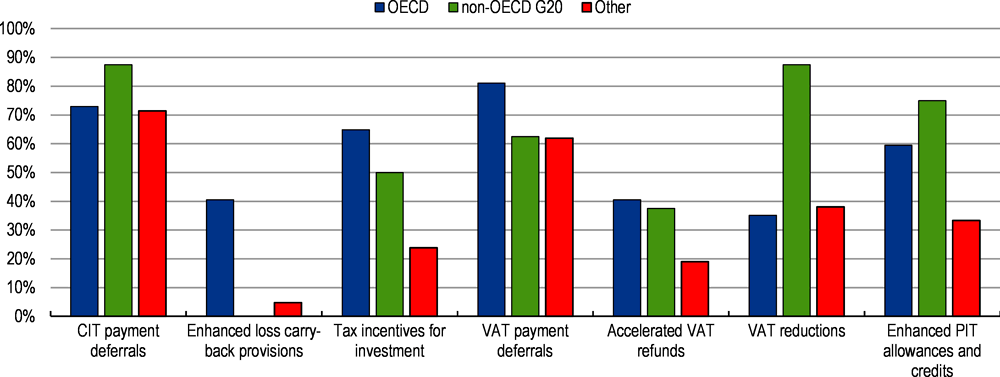

2 Update On The Tax Measures Introduced During The Covid 19 Crisis Tax Policy Reforms 2021 Special Edition On Tax Policy During The Covid 19 Pandemic Oecd Ilibrary